More Than a Credit Report: TransUnion Supports Lenders Throughout the Entire Mortgage Lifecycle

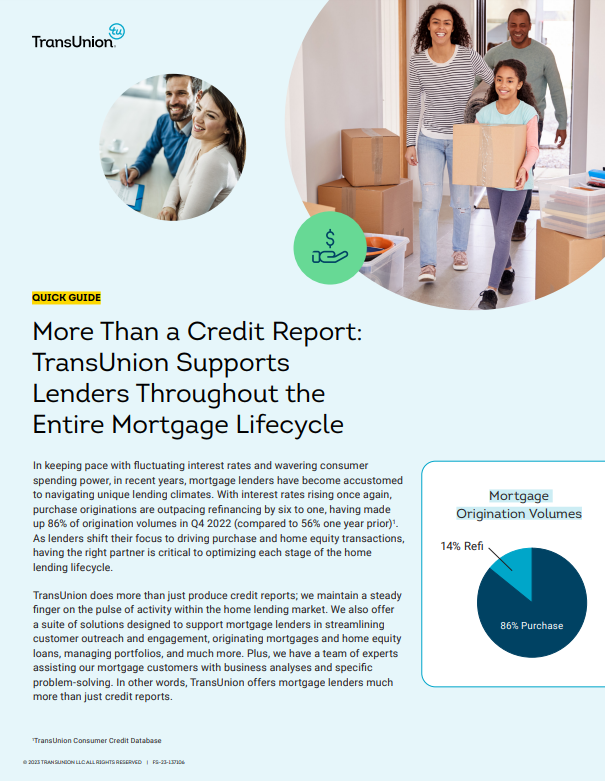

As interest rates climb and purchase loans continue to outpace refinancing, the mortgage industry is experiencing another unique year in lending. With fewer consumers in-market, it’s critical lenders optimize each stage of the home lending lifecycle in order to achieve desired outcomes.

TransUnion is equipped to help. From maintaining a steady pulse on the home lending market to offering a suite of mortgage solutions designed to safely maximize results to deploying our team of in-house mortgage experts for direct customer consultations, TransUnion does far more than just produce credit reports.

Read our guide to learn how we can specifically help mortgage lenders:

- Generate leads in a purchase market

- Build pipelines and nurture client relationships

- Achieve more nuanced prospecting via deeper, broader audience insights

- Improve the quality of customer and prospect data

Download the Guide